We represent the future of Marketing

Dreamland Marketing

Dreamland Marketing is one of the Leading Real estate Marketing company in Pakistan with headquarter located in F11 Markaz, Islamabad. The company has more than 12 years of experience in the field of real estate. With various services ranging from sales to project marketing, the company has seen high growth in recent years. The company helps buyers, owners, and investors by understanding their real estate needs and giving them the right advice about property buying and investment.

BEST INVESTMENT OPPORTUNITIES

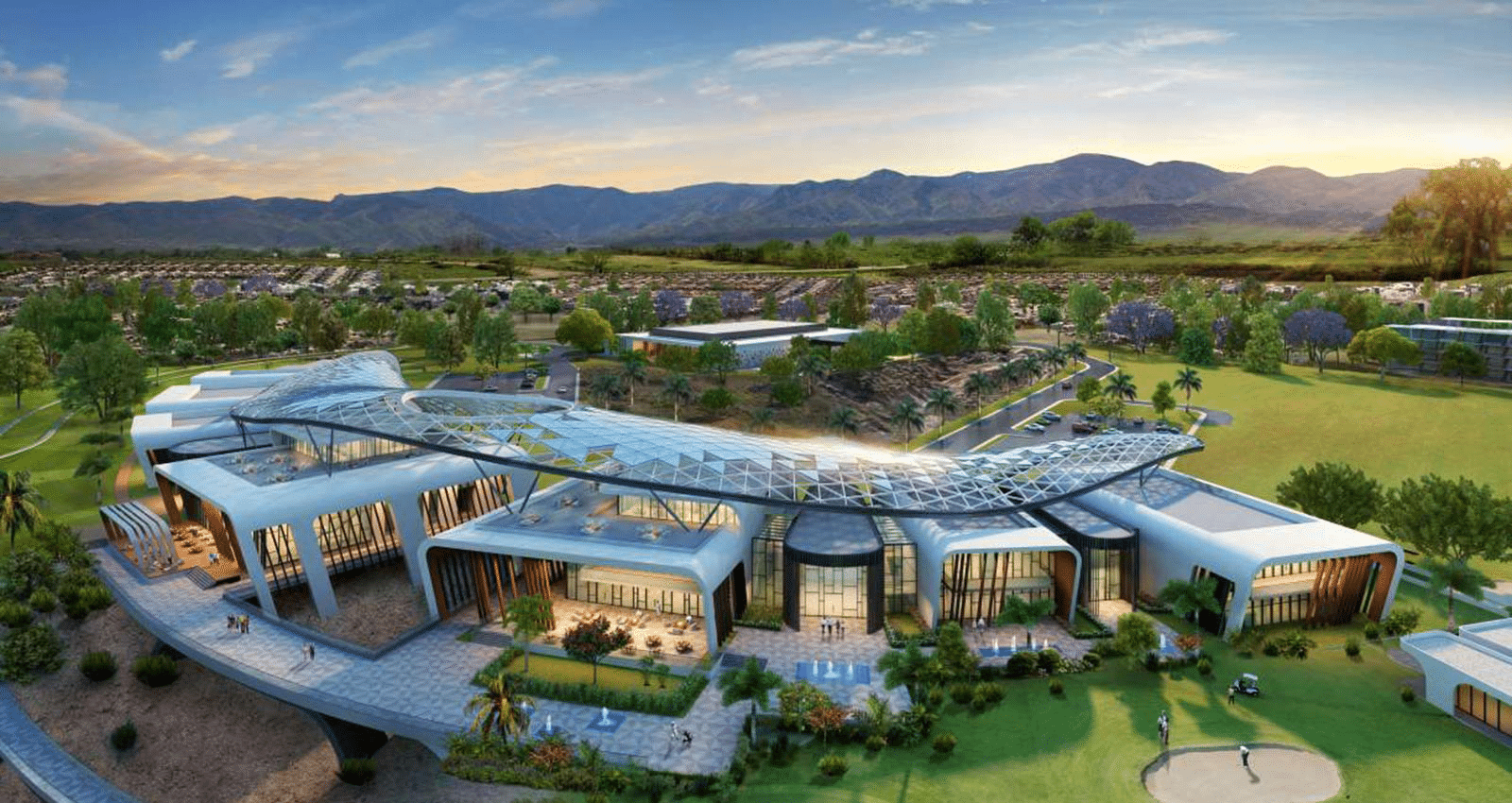

Our Projects

We deal in a number of societies that have an exponential increase in terms of Development, Profitability, and Living Standards.

Why Dreamland Marketing

Revolution in Real Estate

Our aim is to revolutionize the real estate industry in Pakistan by using modern marketing techniques and mass communication to strengthen our relationship with our clients.

Successful Deals

+

Happy Clients

+

TESTIMONIALS

Know About Our Customer Say

Shahid Ahmed

Danish Malik

I’m thankful to the Dreamland Marketing for their efficient consultancy as they helped me make the right decision.

Ali Baig

Dreamland Marketing is a dedicated Marketing company with professional morals and honesty that one needs while having a consultation to buy a property.

Looking for a Trustable services

WE ARE 24/7 AVAILABLE

051-8358749

We will keep you up to date with all of the latest Projects & construction news

January 30, 2023. 11:53 AM

Tower 12 Islamabad by Dreamland Marketing

Tower 12 Islamabad is an 11-story high-rise commercial building in New Blue Area Islamabad, exactly located on Jinnah Avenue. It is allegedly approved by CDA and is developed by Nauman Builders and Pioneer Group. The developers are well-known real estate companies contributing to the industry and the country’s success. The

August 27, 2022. 12:04 PM

Successful Business Man

Tips To become a successful Business Man. Success doesn’t mean you have lot of Money “Doing business isn’t for the faint of heart. It’s for the brave, the patient, and the persistent. It’s for the overcomer.” This anonymous quote perfectly describes the character of a successful small business owner. It

August 26, 2022. 7:40 AM

Tips for Hiring

Tips for Hiring a Local Real Estate Agent Everyone dreams of a better place of living. Whether you buy or sell a new house; an agent’s knowledge is always better. Expert’s estate agents can help you to sell the house at the best possible price. Hiring a professional is beneficial

August 2, 2022. 6:49 AM

Home Loans

Have you ever dreamed of having a house of your own where you would be under no obligations to follow certain fixed rules? Have you ever dreamed to cut off those shackles binding you and live peacefully in your humble abode? Have you ever considered loaning a certain amount from

August 1, 2022. 10:27 AM

Islamabad gets new Buses

The Islamabad administration is all set to launch two environment-friendly electric feeder buses for Green and Blue Line metro services. DA Chairman Amer Ali Ahmed made the announcement during a meeting with all the board members of the authority. As per the details available in news reports, the project’s been

July 30, 2022. 7:55 AM

What to look for in a House?

Location, price tag, and square footage are not the only factors that should influence your decision when buying a family home. Apart from the design elements that are mandatory for your convenience and comfort, it is also important to think ahead and pinpoint the features that will ensure a quality

I had great experience with Dreamland Marketing. Thanks for helping me purchasing a property in Islamabad. Highly recommended..!